From Contract to Keys: A Buyer's Manual for Purchasing a Home in Tennesse

Are you considering buying a house in Tennessee? This blog is the manual you need! As the real estate market gradually adjusts post-pandemic, navigating the process of purchasing a home in the Volunteer State requires careful planning and informed decision-making.

From understanding market conditions to securing financing and choosing the right location, there are several essential steps to ensure a successful home-buying journey.

Here are the key steps you'll learn about:

-

Save for A Down Payment

-

Find a qualified real estate agent like Middle Tennessee Real Estate

-

Get Pre-approved for a Mortgage

-

Choose the Right Location

-

Start House Hunting

-

Make An Offer

-

Conduct Inspections and Appraisals

-

Close on Your New Home

Whether you're a first-time buyer or looking to invest in Tennessee's diverse real estate market, this guide has you covered. Let's dive in and make your dream of owning a home in Tennessee a reality.

Essential Steps For a Successful Home-buying Journey

Understand the Current Market Conditions

Before knowing how to buy a house in Tennessee, it's critical to understand the current market circumstances in Tennessee. The increase in mortgage rates results in increased monthly mortgage payments for purchasers, making it essential to account for these expenses when planning a house purchase.

Despite rising mortgage rates, several property markets in Tennessee are seeing regular price decreases and fewer competitive bids. This allows motivated purchasers to negotiate attractive bargains and select residences that fit their budgets and tastes.

Save for a Down Payment

One of the first stages in the home-buying process in Tennessee is to save for a down payment. While common knowledge dictates a 20% down payment on the purchase price, many lending choices allow for smaller down payments.

Government-backed loans, such as VA and FHA loans, have down payment requirements as low as 0% and 3.5%, respectively, making homeownership more accessible to various consumers.

However, there are several factors to consider when choosing a lesser down payment. Buyers should be aware of any negatives, such as increased monthly payments and the need for mortgage insurance. Investigating down payment aid programs in Tennessee may also give further financial help to qualified purchasers, reducing the strain of upfront payments.

Find a Qualified Real Estate Agent

Navigating Tennessee's real estate market takes the knowledge of a skilled real estate agent like Middle Tennessee Real Estate. Whether you're a first-time buyer or an experienced investor, having a qualified agent on your side may help you navigate the home-buying process and get valuable insights into local market trends.

Consider experience, transaction volume, and customer feedback when choosing a real estate agent. Using agent matching services or interviewing various agents might help you locate the best agent for your requirements and preferences.

Get Pre-approved for a Mortgage

Getting pre-approved for a mortgage is essential in home-buying since it shows sellers that you are a serious and qualified buyer. Preapproval is when a lender evaluates your financial status and issues you a preapproval letter showing the maximum loan amount for which you are qualified.

To keep your preapproval status, avoid making significant financial changes that might affect your creditworthiness, such as establishing new credit accounts or skipping loan payments. Securing preapproval gives you a competitive advantage in negotiations and streamlines the homeownership process.

Choose the Right Location

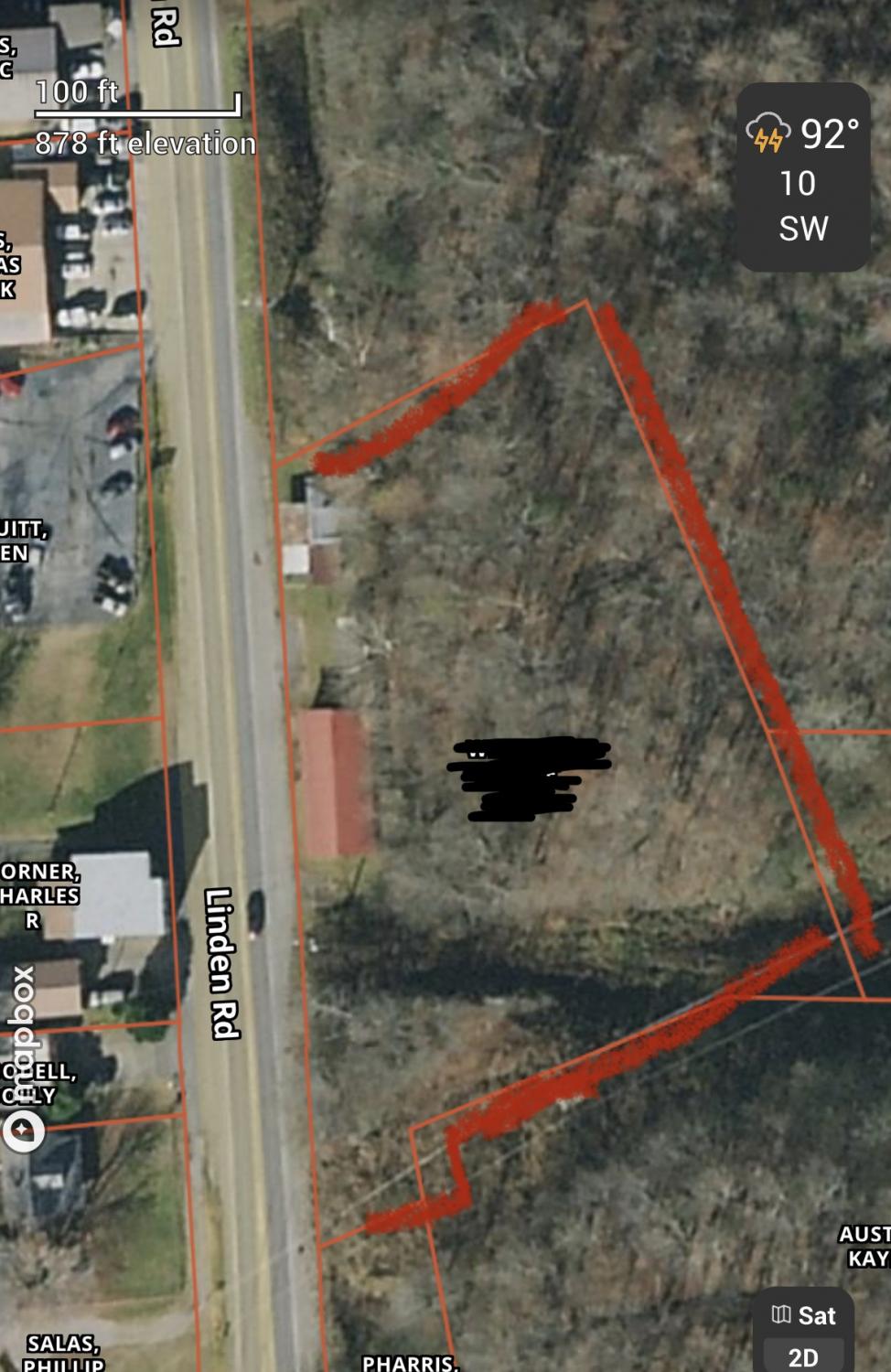

Choosing the ideal location for your new home is critical to your overall pleasure and long-term investment possibilities. When comparing regions in Tennessee, consider housing costs, local amenities, and future development potential. Additionally, when choosing the right land, assess factors such as geographic features, proximity to essential services, and zoning regulations to ensure they align with your needs and aspirations.

Researching previous property value patterns might reveal anticipated appreciation rates and market stability. By picking communities that match your tastes and financial limits, you may reduce your search and concentrate on houses that fulfill your requirements.

Start House Hunting

Once you've determined your target areas and acquired financing, it's time to begin home searching in earnest. Explore available homes in your target location by using online listing platforms, attending open houses, and working closely with your real estate agent.

During the home shopping process, make a list of your must-haves and prioritize things that are essential for you and your family. Prepare to respond swiftly in competitive markets since attractive homes may get many bids within a short period of time.

Make an Offer

When you locate a house that fulfills your requirements, it's time to submit an offer. Like Middle Tennessee Real Estate, your real estate agent will help you create a competitive offer that aligns with market circumstances and accurately represents the property's worth. In fast-paced markets, be prepared to respond quickly and even make numerous home offers before receiving an acceptance.

Inspections and Appraisals

After reaching an agreement with the seller, the following processes include inspections and appraisals to determine the property's condition and worth. Home inspections provide a complete review of the property's structural integrity as well as the identification of any possible concerns or risks.

In addition, an appraisal is performed to evaluate the home's fair market value and ensure that it fits the lender's lending requirements. Inspections and assessments both give helpful information that may guide discussions and, perhaps, lead to changes in the selling conditions.

Close on Your New Home

The last stage in house-buying is to close on your new property. During the closing procedure, you will examine and sign any legal papers, pay closing charges, and formally assume the home's title. Before completing the sale, perform a last tour of the house to ensure it matches your expectations.

Lender fees, title and escrow charges, prepaid expenditures, and other expenses are typical closing costs.

Understanding and preparing for these expenditures can help achieve a smooth and flawless closing process.

Conclusion

Buying a home in Tennessee may be a rewarding experience with the proper information and preparation. Following the procedures in this blog and collaborating closely with a skilled real estate agent like Middle Tennessee Real Estate, you may confidently navigate the house purchasing process and accomplish your homeownership objectives. Despite market volatility and economic uncertainty, Tennessee provides various housing alternatives and chances for buyers to discover their ideal house.

Frequently Asked Questions:

How much down payment do I need for a house in Tennessee?

Most standard house loans need 20% of the purchase price upfront. However, other forms of mortgages, such as an FHA loan, require far less. Regardless, you'll want to ensure you have enough money to make a substantial down payment.

What credit score do you need to buy a house in Tennessee?

The minimum credit score for everyone on your loan application is 640. If you need to know your credit history, your lender can look it up. If your credit score does not meet the minimum requirements, you may work with a THDA-Approved Counselor to improve it.

What are the requirements to buy a home in Tennessee?

In Tennessee, homebuyers may be required to make a 20% down payment on their mortgage, but low- and zero-down-payment choices are also available. When reviewing your application, lenders use indicators such as your credit score and income-to-debt ratio.

© 2024 Listings courtesy of RealTracs, Inc. as distributed by MLS GRID. IDX information is provided exclusively for consumers' personal non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. The IDX data is deemed reliable but is not guaranteed by MLS GRID and may be subject to an end user license agreement prescribed by the Member Participant's applicable MLS. Based on information submitted to the MLS GRID as of April 28, 2024 10:00 AM CST. All data is obtained from various sources and may not have been verified by broker or MLS GRID. Supplied Open House Information is subject to change without notice. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information. Some IDX listings have been excluded from this website.

© 2024 Listings courtesy of RealTracs, Inc. as distributed by MLS GRID. IDX information is provided exclusively for consumers' personal non-commercial use and may not be used for any purpose other than to identify prospective properties consumers may be interested in purchasing. The IDX data is deemed reliable but is not guaranteed by MLS GRID and may be subject to an end user license agreement prescribed by the Member Participant's applicable MLS. Based on information submitted to the MLS GRID as of April 28, 2024 10:00 AM CST. All data is obtained from various sources and may not have been verified by broker or MLS GRID. Supplied Open House Information is subject to change without notice. All information should be independently reviewed and verified for accuracy. Properties may or may not be listed by the office/agent presenting the information. Some IDX listings have been excluded from this website.